Mortgage Myth Busting: Can Two Self-Employed People Get a Joint Mortgage?

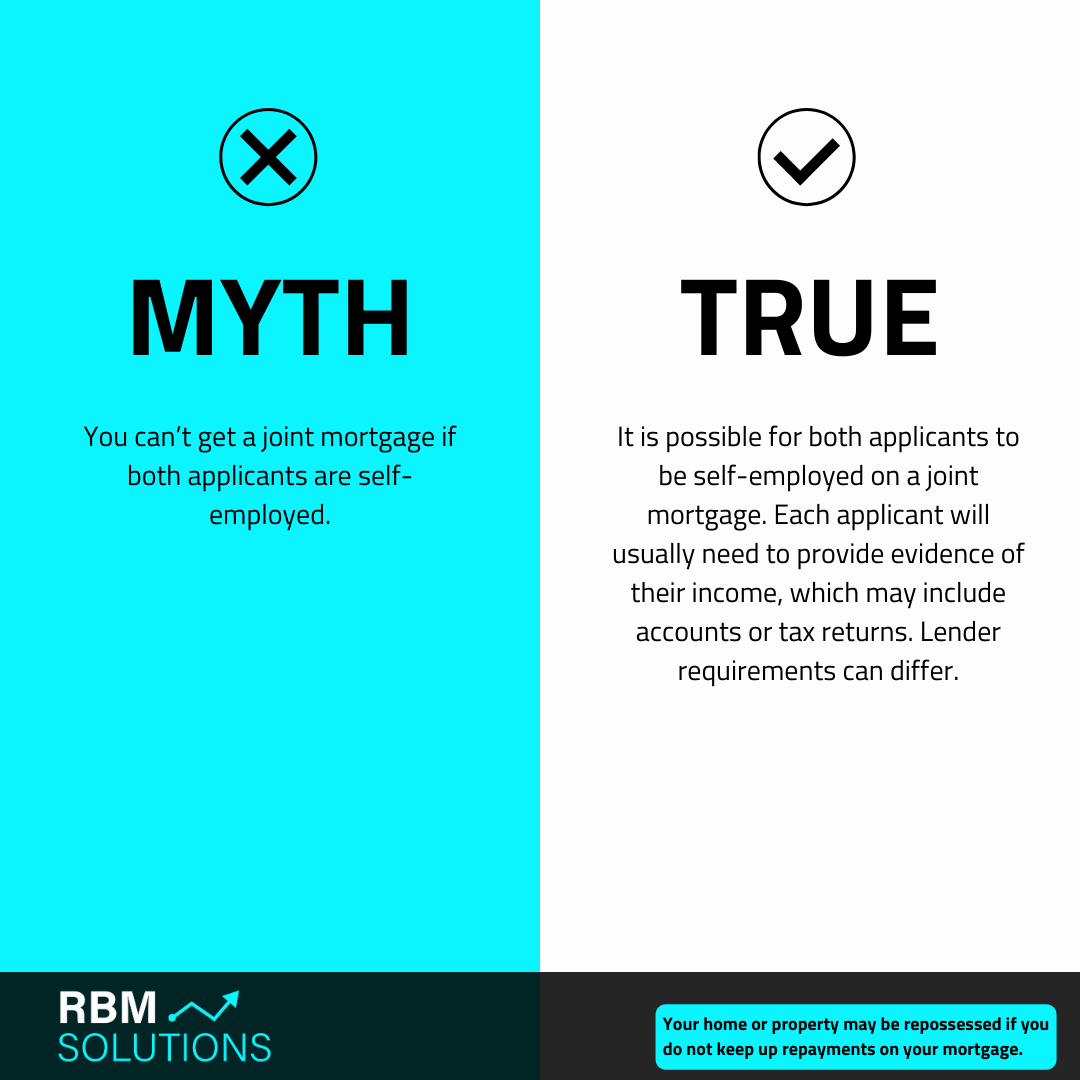

One of the most common misconceptions in the property world is that two self-employed people cannot apply for a joint mortgage. The truth is, they absolutely can.

The key difference lies in the paperwork. Lenders often require more detailed proof of income from self-employed applicants compared to salaried employees. This may include:

Tax returns (SA302s)

Full accounts prepared by an accountant

Evidence of ongoing contracts or regular work

Each lender has different criteria, so while one might be stricter, others may be more flexible. That’s why it’s important to work with a broker who understands the self-employed mortgage market and can match you with the right lender.

At RBM Solutions, we help self-employed buyers and business owners navigate the process with confidence.

📧 info@rbmsolutions.co.uk

📞 02393 233 267

🌐 www.rbmsolutions.co.uk

⚠️ Your home or property may be repossessed if you do not keep up repayments on your mortgage.